A Comprehensive Guide to ABFRL Share Price: Trends, Analysis, and Future Prospects

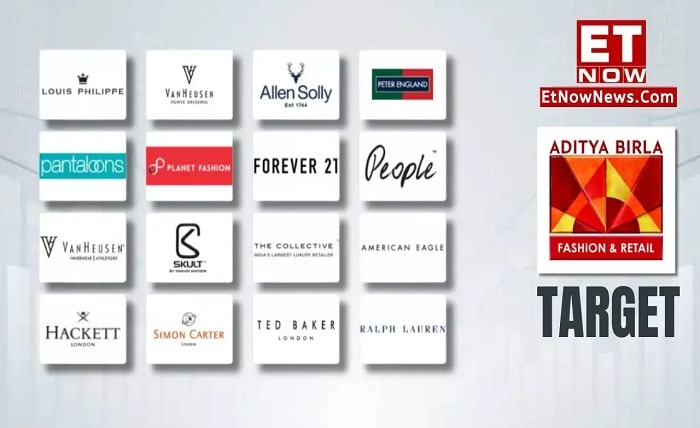

The ABFRL share price has been a topic of interest for both retail and institutional investors. Aditya Birla Fashion & Retail Ltd (ABFRL) is one of India’s largest fashion retail companies, owning prominent brands like Pantaloons, Van Heusen, and Allen Solly. Investors closely track the ABFRL share price to gauge the company’s financial health and growth potential. In this blog post, we will take a deep dive into the factors that impact ABFRL share price, its performance over time, and what the future holds for the company.

Historical Performance of ABFRL Share Price

To understand the future trajectory of the ABFRL share price, it’s important to look at its historical performance. Over the past few years, ABFRL share price has seen significant fluctuations. Factors like changes in market sentiment, the retail sector’s performance, and the company’s quarterly earnings have had a direct impact on its stock price.

From a long-term perspective, the ABFRL share price has shown resilience, especially during periods of economic growth in India. The company has expanded its footprint both in physical retail stores and in the digital realm, which has boosted investor confidence and, in turn, influenced the ABFRL share price positively. Tracking this historical data can provide valuable insights into how the stock might perform under similar conditions in the future.

Key Factors Influencing ABFRL Share Price

Several factors influence the ABFRL share price, and understanding these is crucial for investors. Let’s look at some of the key factors:

- Market Conditions: The retail sector, like any other, is highly sensitive to the overall market conditions. A booming economy often leads to increased consumer spending, positively affecting the ABFRL share price.

- Brand Performance: The performance of ABFRL’s flagship brands, including Pantaloons and Van Heusen, plays a significant role in the company’s overall revenue and profitability. Strong brand performance tends to positively influence the ABFRL share price.

- Quarterly Earnings Reports: The ABFRL share price tends to react strongly to quarterly earnings reports. Positive earnings results, including higher-than-expected revenues and profits, can send the share price soaring, while disappointing earnings can lead to a fall in share price.

- Market Sentiment: The sentiment around the Indian fashion retail industry also has a direct impact on ABFRL share price. Positive news about the retail market often boosts ABFRL’s share price.

- External Factors: External factors like government policies, the retail sector’s regulatory environment, and global economic conditions can also influence the ABFRL share price.

ABFRL Share Price Performance: Recent Trends

In recent months, the ABFRL share price has witnessed some significant movements. This can be attributed to several factors, including the company’s efforts to adapt to the changing retail landscape. One of the key drivers for the recent uptick in the ABFRL share price has been the company’s strong push towards e-commerce and digital platforms, which helped mitigate the impact of the pandemic on its physical stores.

ABFRL has also made significant investments in fashion brands, which has helped boost investor confidence. These investments have positively impacted the ABFRL share price, as they indicate the company’s long-term commitment to growth and diversification.

Impact of ABFRL’s Strategic Moves on Share Price

ABFRL has undertaken several strategic initiatives over the past year to bolster its market position. For example, the company acquired stakes in various fashion brands, expanded its online presence, and focused on expanding its footprint in tier-2 and tier-3 cities. These initiatives have had a direct impact on ABFRL share price, as investors often see such strategic moves as a sign of long-term growth and stability.

Additionally, ABFRL’s focus on sustainability has further improved its image in the market, attracting a new segment of socially-conscious investors. This growing investor base has contributed to the steady growth of ABFRL share price.

Expert Analysis of ABFRL Share Price Prospects

Experts in the stock market believe that ABFRL share price will continue to see growth in the long run, albeit with occasional volatility. According to financial analysts, the company’s focus on expanding its online presence, along with its strong brand portfolio, positions it well for future growth. As a result, they predict steady long-term growth for the ABFRL share price.

However, the retail sector remains highly competitive, and factors such as fluctuating raw material costs, changes in consumer preferences, and economic downturns could impact ABFRL share price in the short term. Investors are advised to monitor these variables carefully.

How to Invest in ABFRL Share Price?

Investing in ABFRL share price can be done through various channels. The most common way is by purchasing shares through the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) via a broker. Investors can also buy the shares via mutual funds that have ABFRL in their portfolio.

It’s important to assess your risk tolerance before investing in any stock, including ABFRL share price. Diversification is a key investment strategy to mitigate risks and increase the potential for returns.

Future Outlook for ABFRL Share Price

Looking forward, the outlook for ABFRL share price remains positive, with several factors working in the company’s favor. The company’s strong brand presence, expanding digital footprint, and strategic investments are expected to fuel growth. Additionally, the ongoing recovery of the retail sector in India post-pandemic is also expected to have a positive impact on ABFRL’s performance and, consequently, its stock price.

In the short term, investors can expect some volatility, but the long-term outlook remains bullish. The ABFRL share price is likely to benefit from both domestic growth and the company’s increasing focus on sustainability and innovation.

Conclusion

The ABFRL share price has experienced significant growth and fluctuations in the past, influenced by various market dynamics, strategic decisions, and external factors. While there will be periods of volatility, the company’s strong fundamentals, diverse brand portfolio, and focus on e-commerce give it a solid foundation for long-term growth. Investors looking to add ABFRL share price to their portfolio should closely monitor quarterly earnings, market conditions, and strategic developments.

By keeping a close eye on these factors, investors can make informed decisions about when to enter or exit positions in ABFRL shares.

FAQs

1. What is the current ABFRL share price?

The current ABFRL share price can be tracked through any major financial news website or stock market app. It fluctuates throughout the day based on market conditions.

2. What factors influence the ABFRL share price?

Several factors influence the ABFRL share price, including market conditions, quarterly earnings reports, brand performance, and external economic factors.

3. Is ABFRL share price expected to rise in the future?

Experts predict steady growth for ABFRL share price in the long run due to the company’s strong brand portfolio, expanding digital presence, and strategic investments.

4. How can I invest in ABFRL shares?

You can invest in ABFRL shares through stock exchanges like NSE or BSE via a broker or by purchasing mutual funds that include ABFRL in their portfolio.

5. What is the outlook for ABFRL share price in 2025?

The outlook for ABFRL share price in 2025 remains positive, with several growth drivers like the expansion of e-commerce and strategic acquisitions supporting its long-term growth.